How To Pay Pcb For Employer

Designate the appropriate staff to execute payments and purchase securesign.

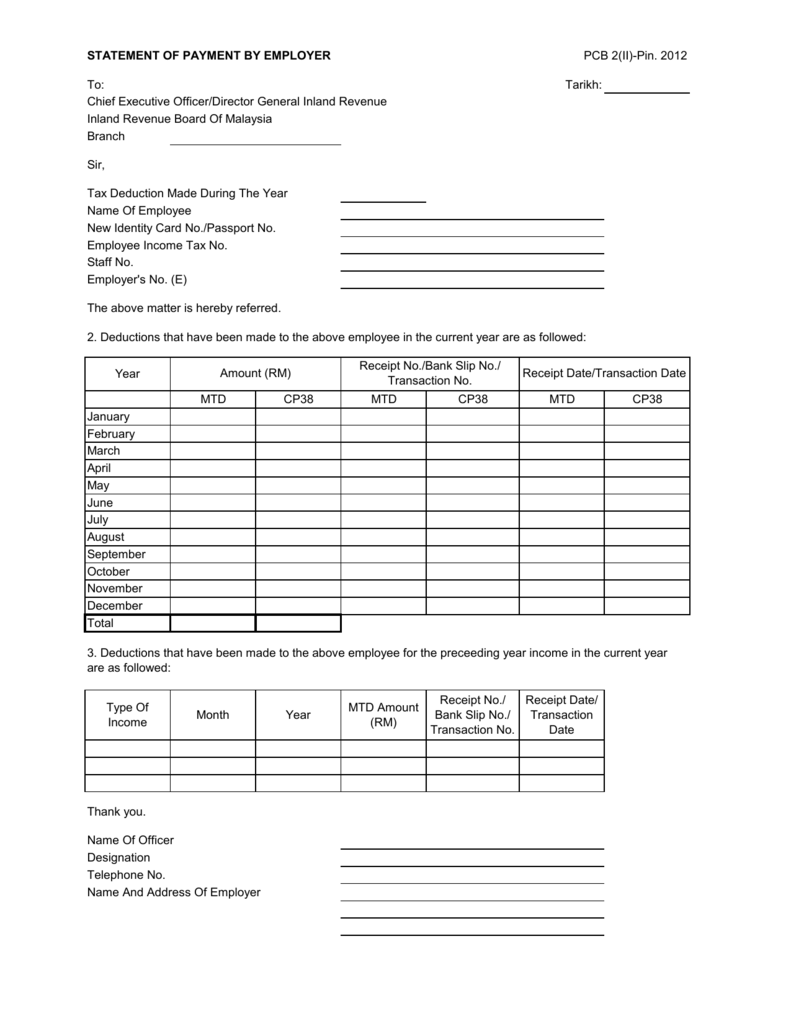

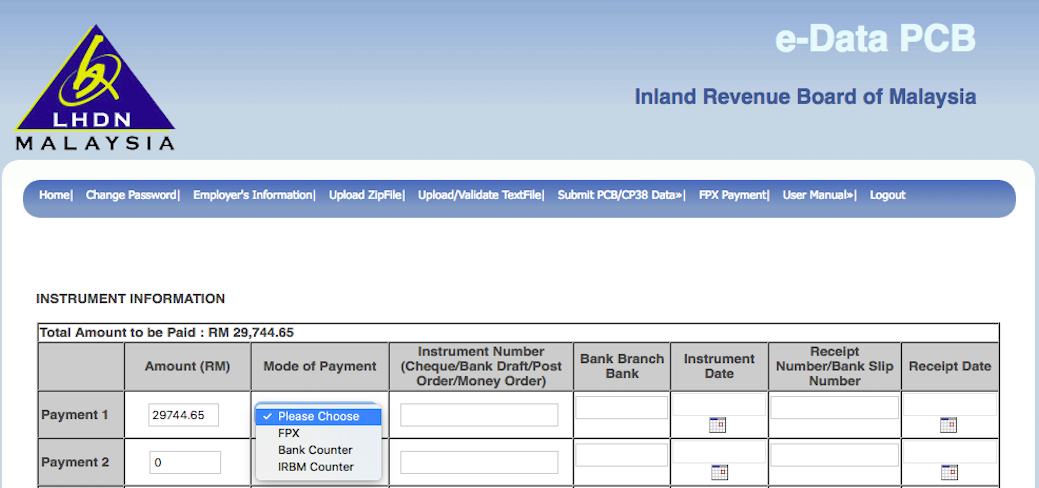

How to pay pcb for employer. How do i pay pcb. Sg 1234567 08 0 employee s full name. The payment received date is the payment date through fpx. Employer can attach form cp22 or form in lieu of cp39 together with form cp39 when make mtd payment.

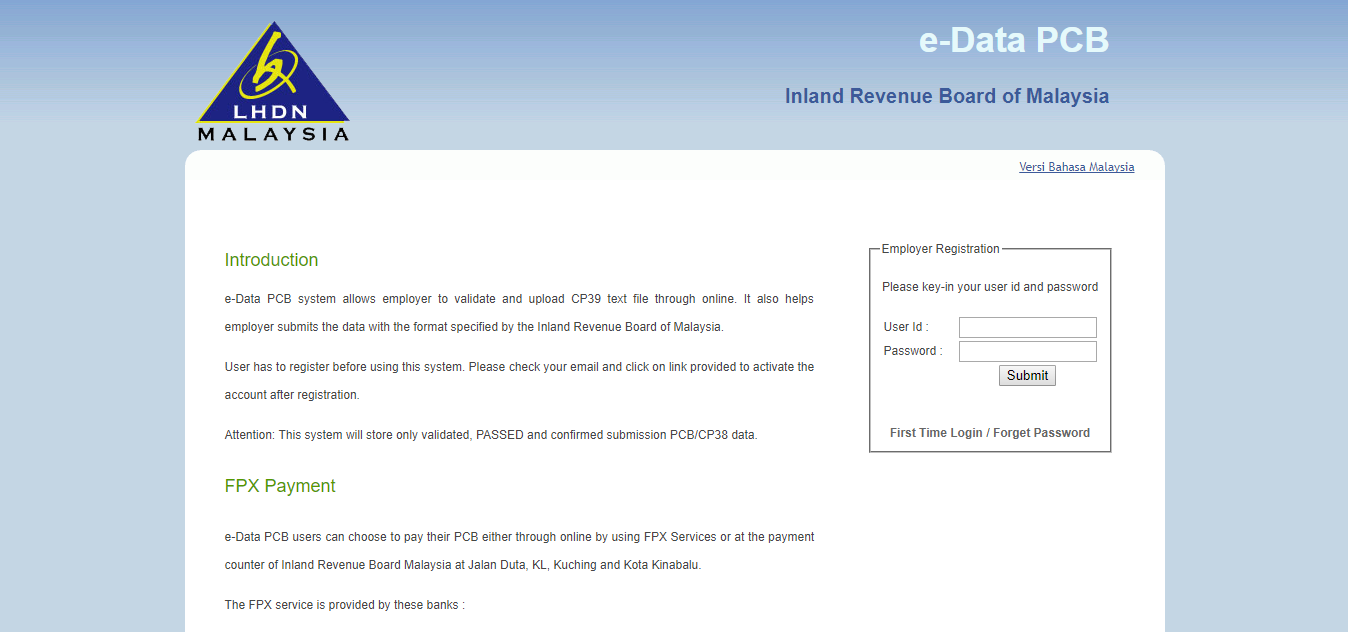

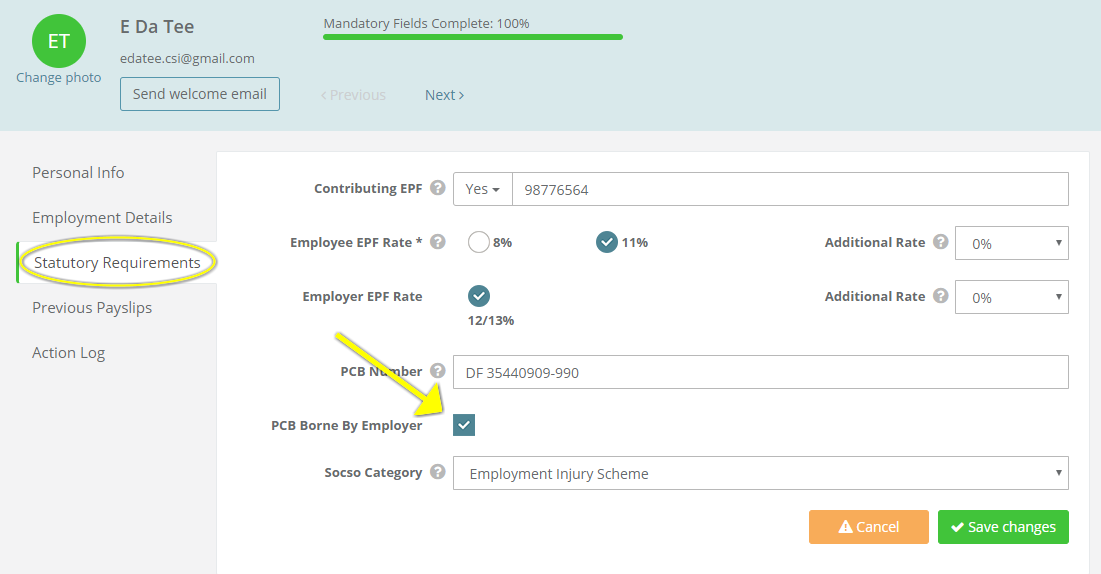

Pcb is deducted from the employees salary and it is the employer s responsibility to ensure that the necessary amount is deducted accordingly. E data pcb users can choose to pay their pcb either through online by using fpx services or at selected banks. Leave blank this item if the employee does not have an income tax number. The employer or the company in question will then remit the amount deducted from the salary to the inland revenue board by no later than the 10 th day of the following month.

Apply for pbe s business banking. If you are currently submitting pcb file using diskette you can upload the file directly through pbe. The fpx service is provided by these banks. The slip bank is an acknowledgement receipt of payment by the employers.

Pcb payment should be made with the submission of form cp39 statement of monthly tax deduction.